The Perfect Storm: Why Venture Capital's Liquidity Crisis Is Reshaping Startup Funding

When Goldman Sachs announced it would acquire Industry Ventures for up to $965 million last week, the deal underscored a seismic shift happening beneath the surface of venture capital: the secondary market has exploded from a niche tool into a $152 billion necessity, fundamentally changing how startups get funded and how investors get paid back. This isn't just another acquisition. It's indicative of what many are calling venture capital's most significant structural crisis in over a decade.

Understanding the Perfect Storm

To understand why the secondary market has become so critical, you need to understand three converging forces that have created a perfect storm for venture capital:

Force #1: The Exit Market Collapsed

Venture capital has traditionally depended on IPOs and acquisitions for liquidity. However, these traditional exit mechanisms have been severely constrained since 2022. After a record 311 venture-backed IPOs in 2021, the market crashed, producing just 38 IPOs in 2022, 54 in 2023, and only 72 companies went public in 2024

In addition, companies are staying private much longer. The average time from first financing to IPO has stretched from around 5 years in the mid-2000s to over 8 years today. At the extreme end, the 90th percentile has increased from 8 years in 2005 to 13.6 years in 2018.

WHY THIS MATTERS: Venture capital funds typically have a 10-year lifespan. When companies take 11+ years to exit, the fund lifecycle model breaks down. Limited Partners (“LPs”) who invested in 2015-2017 funds expected returns by now, but many portfolios are still locked up with paper gains that can't be converted to cash.

Force #2: Limited Partners Are Demanding Distributions

Distributions from venture capital have plunged to levels not seen since the 2008 financial crisis. Limited partners—the pension funds, endowments, and institutions that invest in VC funds—are facing what's called a "distribution crisis." As one pension fund manager captured the frustration: "Getting cash back has become so important that we decided not to recommit to several brand name firms who didn't provide enough liquidity from their older funds."

The metric everyone now obsesses over is DPI (Distribution to Paid-In Capital)—how much actual cash has been returned relative to what was invested. Funds from 2016-2019 vintages are significantly underperforming historical averages. LPs are responding by refusing to recommit to even brand-name VC firms that haven't delivered liquidity.

Force #3: VCs Can't Raise New Funds Without Returns

Here's where the cycle becomes vicious: VCs need to show distributions to raise their next fund. But without exits, they can't generate distributions. The result? Fundraising has collapsed.

In 2024, VCs only raised $76.1 billion, the lowest since 2019 and launched just 508 new funds, the second-lowest count since 2014. Meanwhile, there's $307.8 billion in "dry powder" (committed but undeployed capital) sitting on the sidelines because investors are waiting for better conditions.

How Secondary Markets Became the Solution

Enter the secondary market—a once-niche corner of venture capital that has transformed into a primary liquidity mechanism.

What's remarkable is how quickly this market has matured. At least five major venture funds have hired full-time staff dedicated to manufacturing non-traditional exits. As Hans Swildens, CEO of Industry Ventures, explained: "All the brand name funds are all staffing and thinking through liquidity structures."

And professional buyers have flooded in. Mega-funds specializing in secondaries have raised unprecedented amounts: Lexington raised a record $23 billion fund, while HarbourVest, Ardian, and Coller Capital have raised funds in the $10-20 billion range.

But what exactly are "alternative exits"?

Type 1: LP Interests (Traditional Secondary Market - ~50% of volume)

In some cases, Secondaries, including mega-funds (see below) purchase entire positions that limited partners (pension funds, endowments, family offices) hold in VC funds. This is the "traditional" secondary market. In 2024, LP-led secondaries accounted for $87 billion in private market secondary transactions, representing 59% of total secondary transaction volume, which represents 60% growth in LP-led secondary transactions year-over-year.

Example: A university endowment invested $50 million in Sequoia Capital Fund XIV in 2016. The fund still has 5 years to go, but the endowment needs cash now to meet spending obligations. HarbourVest buys the endowment's entire position for $40 million (a 20% discount to NAV). HarbourVest now becomes the LP in that Sequoia fund and will receive all future distributions.

Type 2: Direct Secondaries (Company Share Purchases - ~40% of volume)

Existing shareholders (founders, employees, early investors) sell their shares directly to new investors and mega-funds. These transactions include common or preferred stock in specific startups—not a fund position, but actual company shares.

Example: An early-stage VC firm owns 8% of Stripe from a 2015 investment. The fund is approaching end-of-life and LPs are demanding distributions. Rather than wait for Stripe to IPO, the VC sells half their position (4%) to Lexington Partners at a slight discount to Stripe's last $70 billion valuation. The VC gets immediate cash to distribute to LPs; Lexington gets exposure to a proven unicorn.

Type 3: GP-Led Continuation Funds (~10-20% of volume)

General partners create new vehicles to hold portfolio companies beyond the life of the original fund. The GP transfers their best portfolio companies from an aging fund into a newly created "continuation vehicle." Major firms like Lightspeed, NEA, and Insight Partners have all pursued this strategy, with Insight closing a $1.5 billion continuation fund in October 2024.

Example: Lightspeed Venture Partners has a 2014 fund that's reached its 10-year term. The fund still owns stakes in several unicorns that aren't ready to exit. Rather than force sales, Lightspeed partners with a secondary buyer to create a $1 billion continuation fund. The new fund buys just the top 3-5 companies from the old fund. Original LPs can either cash out (sell their position to secondary buyers at current valuation) or roll their investment into the new continuation fund with extended timeline.

The Growth of the secondary market

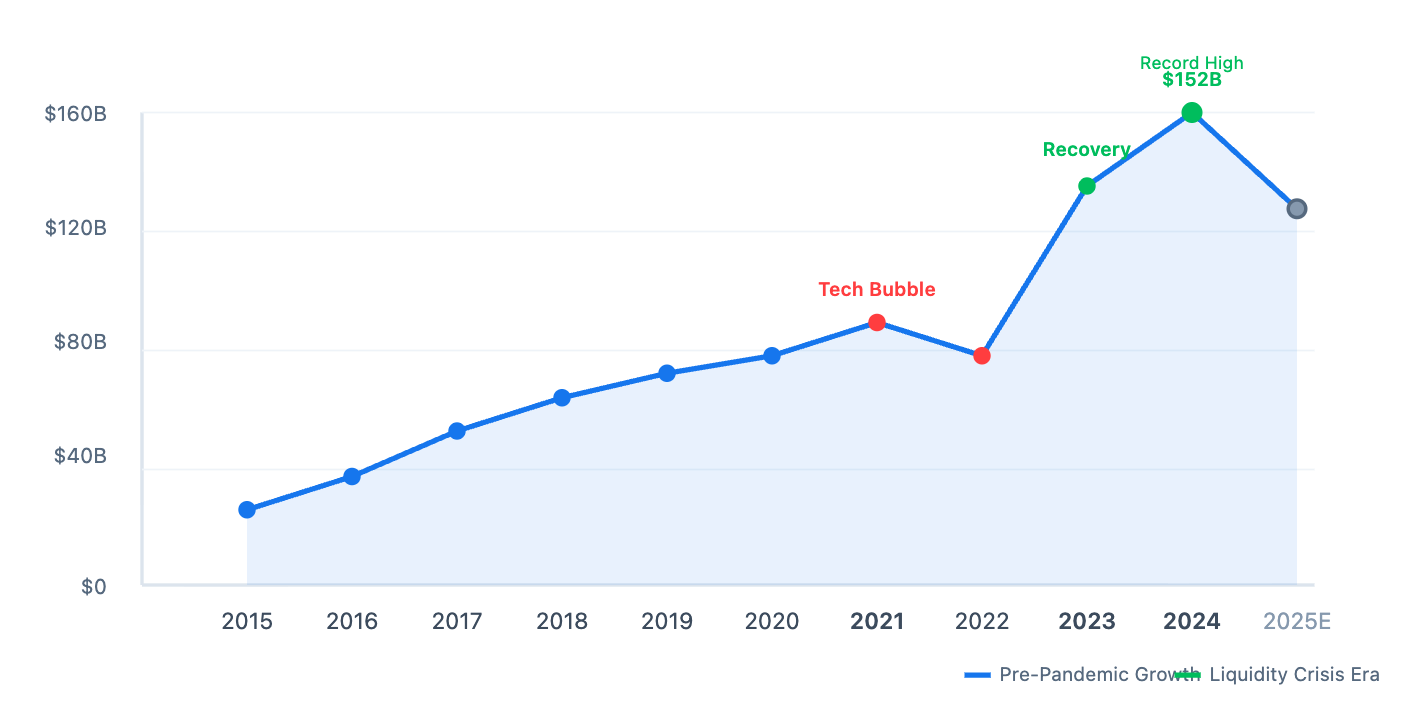

From a $45B niche market to a $152B necessity in just nine years

Impact on Startup Funding: A Tale of Two Markets

Not all companies benefit equally. One institutional investor put it bluntly: "If a company raised capital at 100x annual recurring revenue in 2021, then we don't even bid." This creates a paradox: Secondary markets provide liquidity, but only for companies that are already winning. Struggling companies find even fewer exit options than before.

So what does this mean for entrepreneurs trying to raise capital? The picture is mixed—and increasingly bifurcated.

The Winners: Later-Stage Companies with Strong Metrics

More patient capital: Companies can stay private longer without forcing premature IPOs

Liquidity for stakeholders: Early employees and investors can get partial liquidity through secondaries

Broader investor base: Retail investors and evergreen funds are entering the market, expanding the capital pool

Better pricing: Quality companies now trade at premiums rather than discounts

The Losers I: Struggling Assets

Tier 2 Private market companies:

2021 bubble companies that raised at 100x revenue

Companies without clear path to profitability

Zombie companies staying alive on existing capital

Less access to capital: Fewer investors willing to gamble on profitability

Trading at Deep Discounts: 30-60% BELOW last valuation

The Losers II: Early-Stage Startups

Higher bars: Median revenue for Series A has jumped 75% from $1.4M to $2.5M

Fewer deals: Pre-seed and seed rounds saw the sharpest pullback in Q2 2025

Capital concentration: 57% of North American funding in Q3 2025 went to AI companies

"Series A No Man's Land": Companies that would have raised Series A in 2019 now struggle to find investors

What This Means for Founders in 2025

The VC industry has fundamentally changed its playbook. The days of raising capital at sky-high valuations and waiting for an IPO are over for all but the most elite companies. Instead, VCs are proactively building liquidity structures into their fund lifecycle—and that changes what they look for in investments.

For founders, this creates both challenges and opportunities:

The Challenge: The bar for raising venture capital is higher than ever. Fewer companies will get funded, and those that do will need to demonstrate stronger fundamentals earlier.

The Opportunity: Companies that do get funded may have more patient capital and more flexibility in providing stakeholder liquidity without forcing premature exits. The secondary market creates options that simply didn't exist at scale a decade ago.

If You're Starting a Company:

Focus on unit economics from day one. The bar for early-stage funding has risen dramatically. Investors want to see a clear path to profitability, not just growth at any cost.

Build with capital efficiency. Companies that can reach meaningful milestones with less capital have a significant advantage in this environment.

Prepare for longer fundraising cycles. What might have taken 2-3 months in 2021 could take 6-9 months today.

Consider alternative funding sources. Revenue-based financing, grants, and non-dilutive capital are becoming more attractive.

If You're Already Funded:

Understand secondary options. The rise of secondary markets means you may have flexibility in providing liquidity to employees and early investors without forcing an exit.

Be aware of discount dynamics. If your company isn't in the top tier, secondary sales could happen at 30-60% discounts to your last valuation.

Communicate with investors. VCs under LP pressure may push for earlier exits or secondary transactions to generate distributions.

Final Thoughts

Goldman Sachs' acquisition of Industry Ventures isn't just about one deal—it's a signal that Wall Street views the secondary market as a permanent, profitable fixture of the venture capital ecosystem. With $540 billion in alternative investments to deploy, Goldman is betting big on continued growth.

And they're not alone. The secondary market is projected to handle $122 billion in assets in 2025, yet that still represents just 1.9% of total unicorn value. There's $6+ trillion in untapped liquidity potential.

The transformation of the secondary market from emergency tool to standard operating procedure represents the most significant structural shift in venture capital since the rise of unicorns. It's not a temporary fix—it's a permanent evolution driven by misaligned timeframes between fund lifecycles (10 years) and company maturation (11+ years).

For better or worse, this is the new reality of startup funding. VCs can no longer afford to simply "spray and pray" and wait for exits. They need active liquidity management strategies. And that fundamentally changes what kinds of companies get funded and how.

As one VC put it: "Just going out and seeing companies, putting them in your fund and then waiting for an IPO or strategic M&A exit probably won't work anymore."

Welcome to the new venture capital.

Sources & References

Primary Sources: TechCrunch, PitchBook/NVCA Venture Monitor, Industry Ventures Market Intelligence, Crunchbase News, Jefferies Private Capital Advisory, Evercore Secondary Market Review

Data Period: 2015-2025 (with 2025 figures as projections where noted)

Key Reports:

"How Big Is The Secondary Market for Venture Capital?" (Industry Ventures, January 2025)

"The Secondary Market is Vaulting Over Prior Records" (Commonfund, December 2024)

"VC Benchmark Q2 2025" (The Venture City)